_____, the undersigned Independent Contractor ("CONTRACTOR") A DUTIES OF THE INDEPENDENT CONTRACTOR 1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;Reliable Trucking, Inc Independent Contractor Agreement 1 Independent Contractor Requirement Checklist The following documents are required to be in our office before we may hire your equipment Please make sure all of the required items are in as soon as possible We will be unable to dispatch you, orIndependent Contractor Status The parties acknowledge that Contractor is and shall at all times be an independent contractor and not an employee of the Companies The parties agree a The Companies shall have no right to direct the manner in which Contractor performs the Services;

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

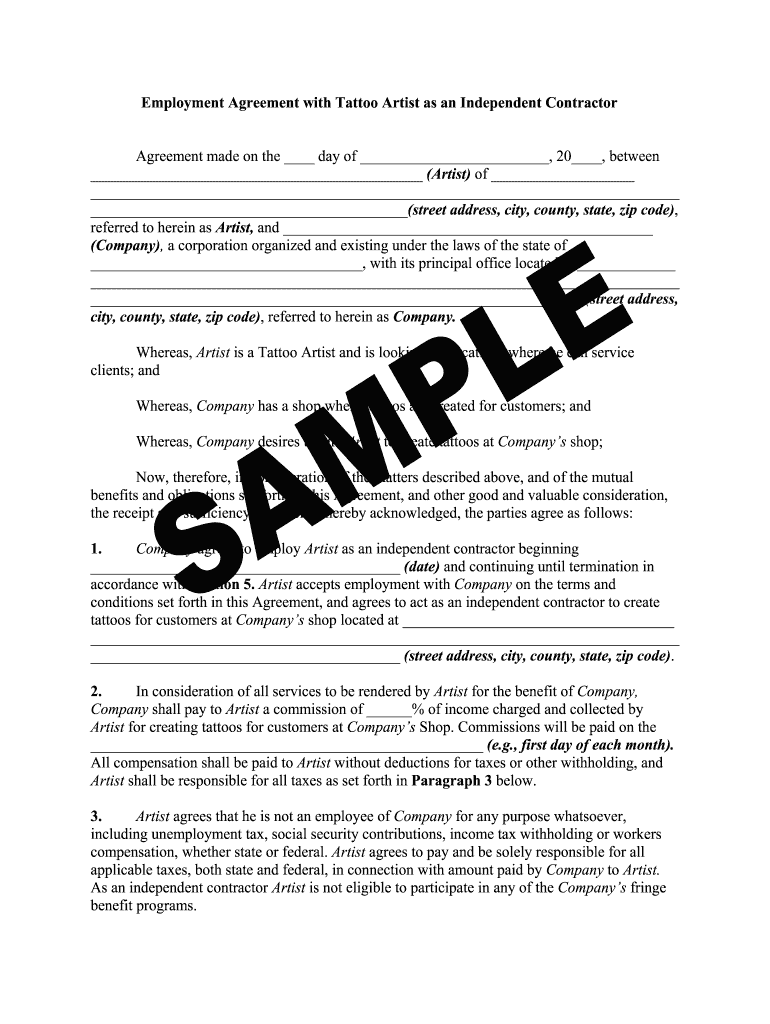

Do independent contractors get a 1099

Do independent contractors get a 1099-49 Sample Independent Contractor Agreements Independent Contractor Agreement Sample download now;(b) Contractor will not violate the terms of any agreement with any third party;

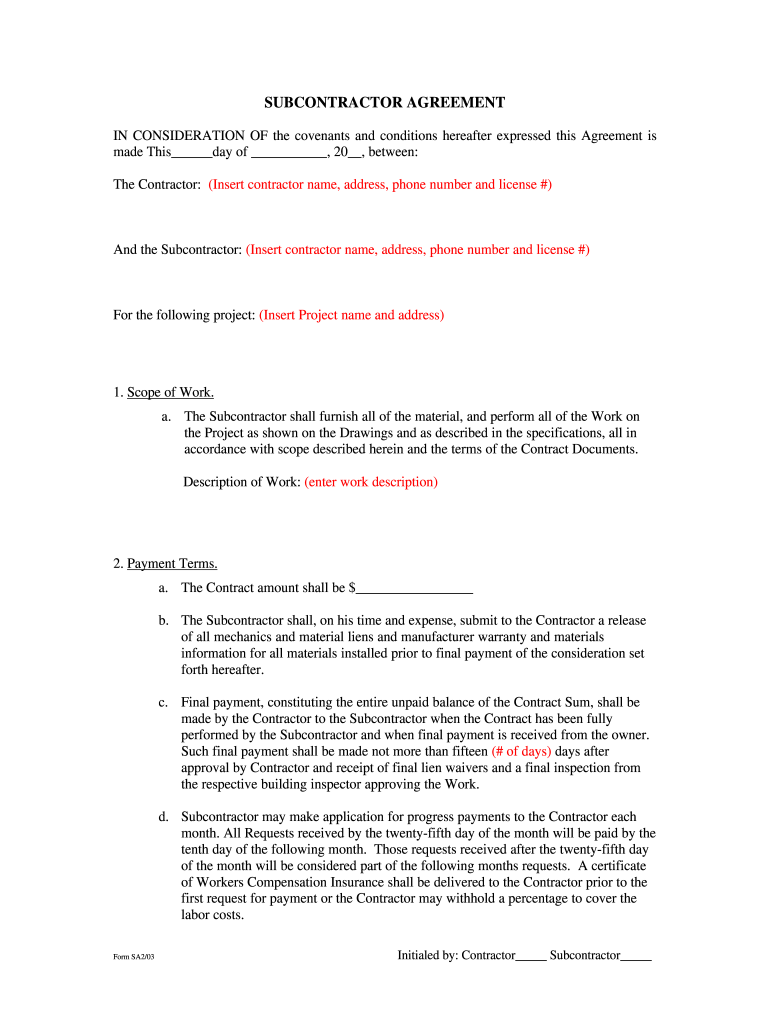

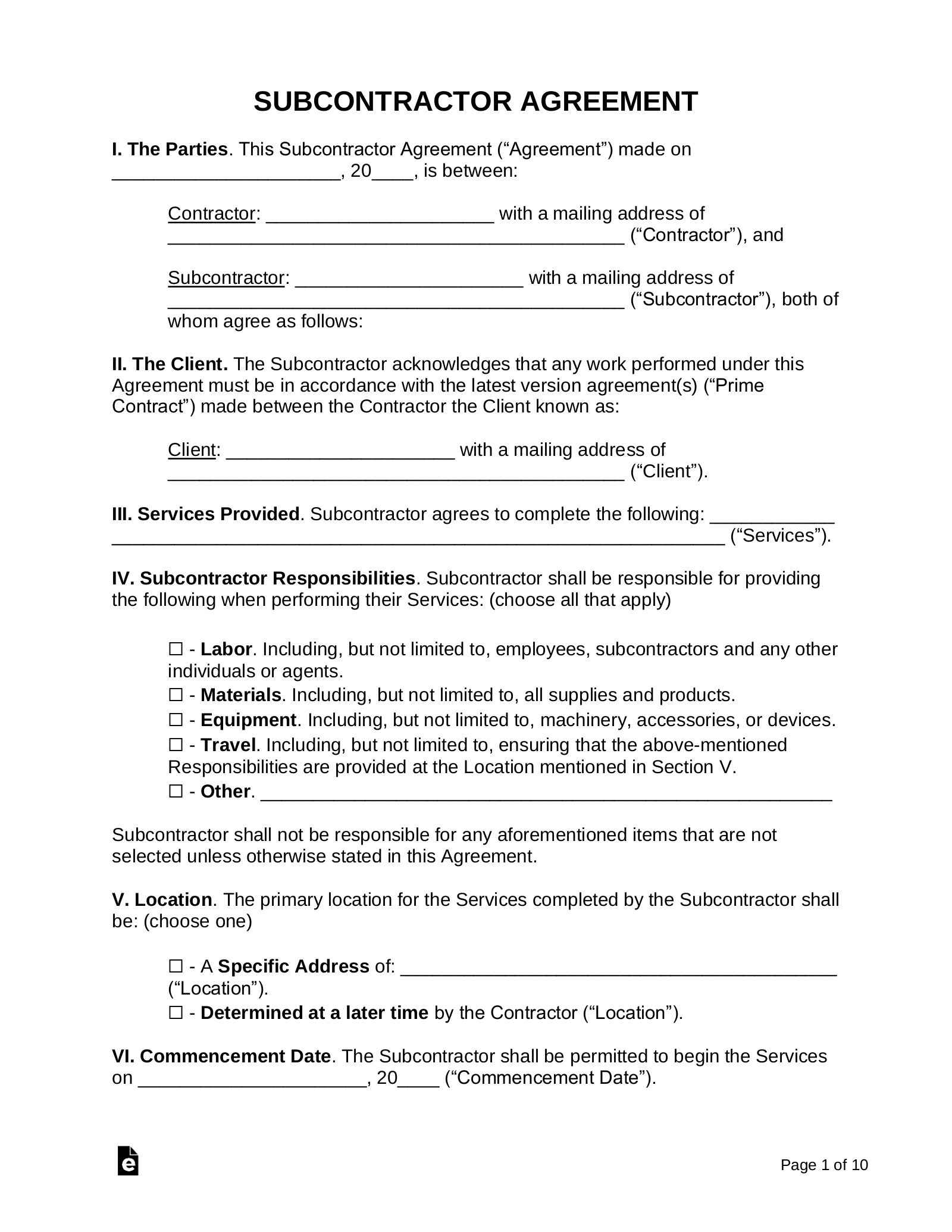

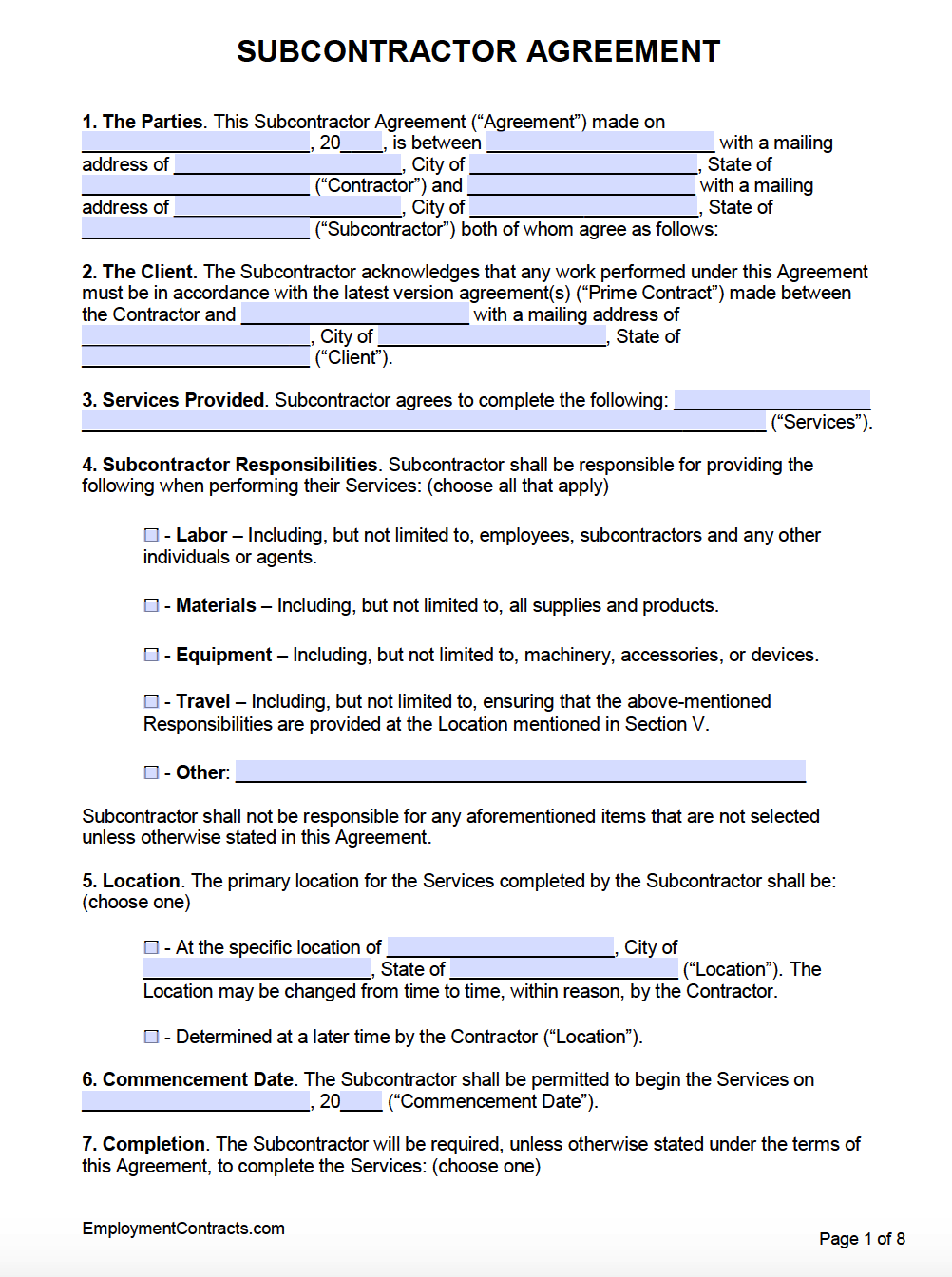

Free Subcontractor Agreement Free To Print Save Download

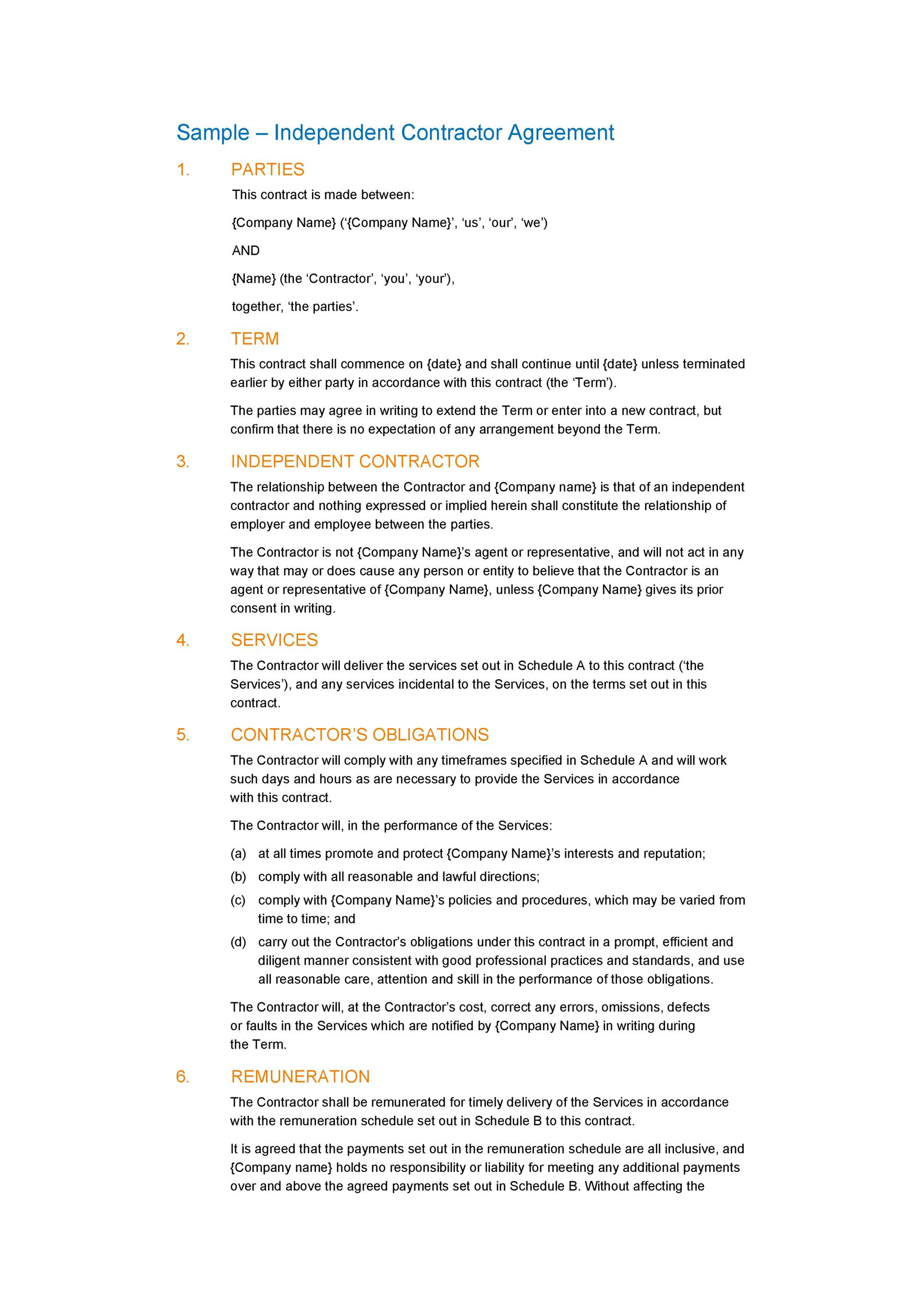

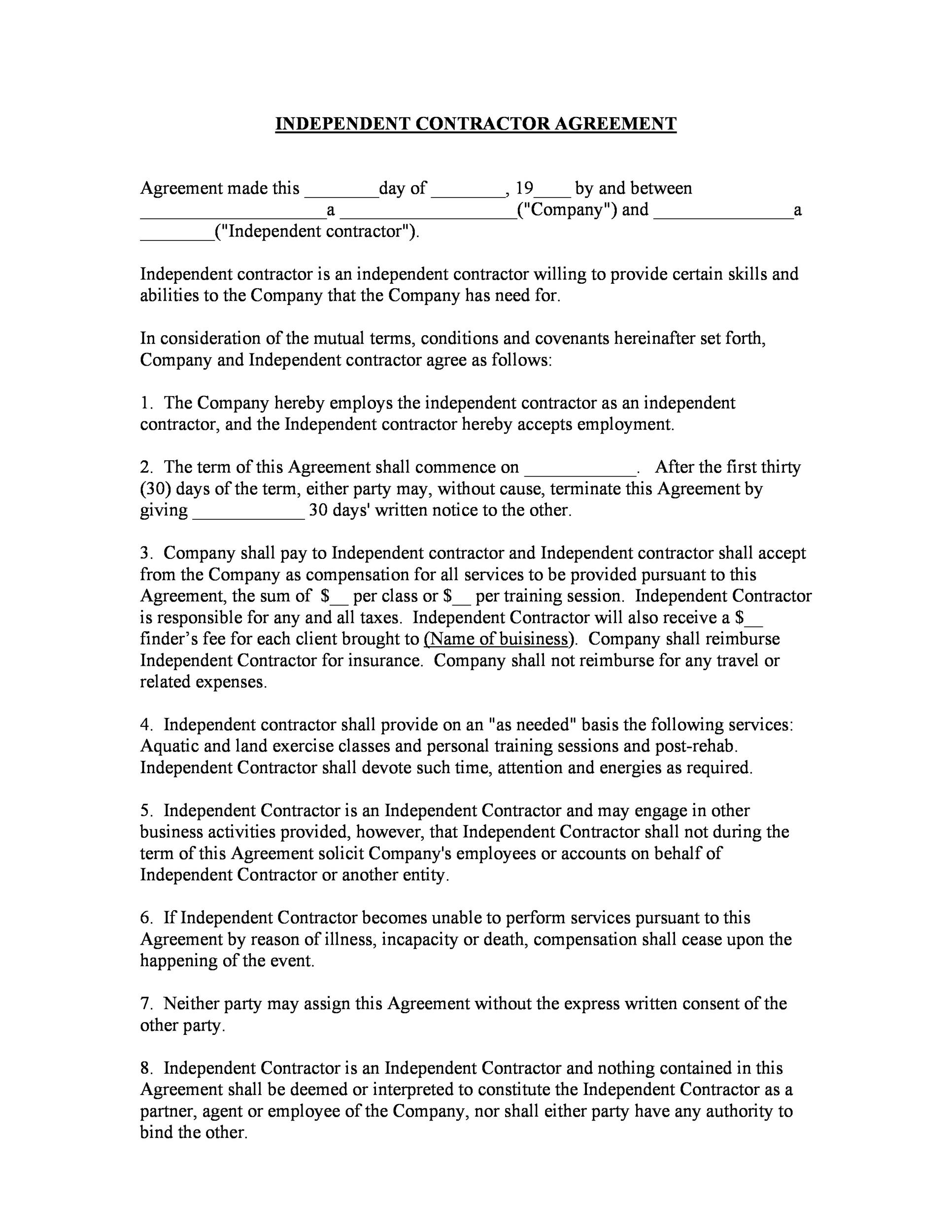

General Independent Contractor AgreementCompany and Independent contractor agree as follows 1 The Company hereby employs the independent contractor as an independent contractor, and the Independent contractor hereby accepts employment 2 The term of this Agreement shall commence on _____ After the first thirtyCONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the other

Independent Contractor Agreement – Angelus Home Health is an equal opportunity employer Page 4 of 4 shall neither have, nor exercise, any control or direction over the methods by which contractor performs work and functions Agency shall not in any manner beHiring independent contractors This setup is widely spread across all company sizes Hiring contractors has multiple benefits the possibility to employ foreign workers or shortterm workers, cost per employee savings, and the ease of contractor relationships Although it's the easiest to set, it can lead to tax evasion charges and IRS audits when local laws and different setups forThe Independent Contractor Agreement is usually for a period or single service However, it could be drafted when you need recurring services from the same independent contractor Both the hiring entity and the independent contractor come up with the agreement Other Names for Independent Contractor Agreement Depending on your state, an Independent Contractor Agreement

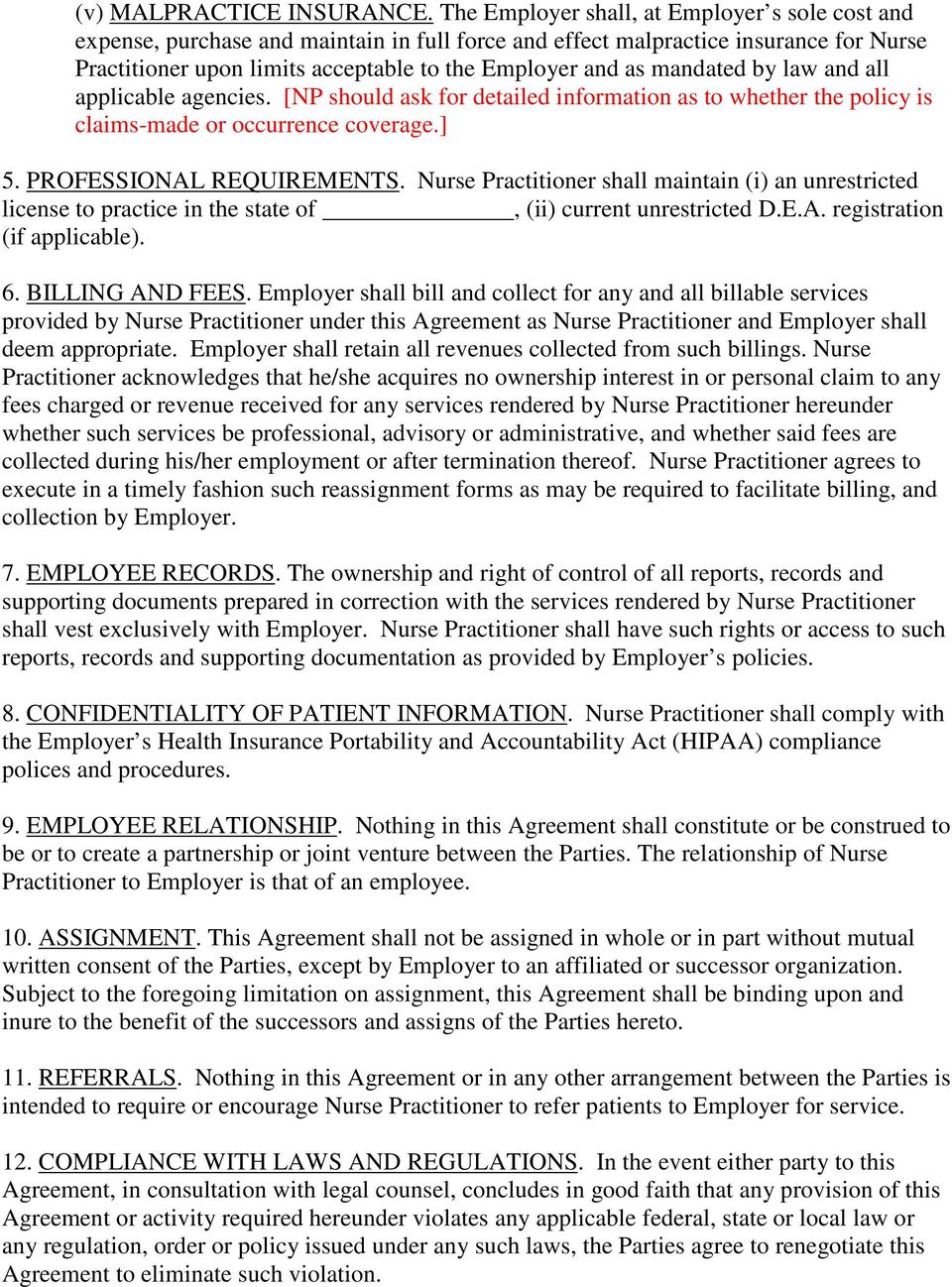

Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themWith US Legal Forms, completing International Independent Contractor Agreement samples or other legal files is not hard 1099 Contractors and Freelancers The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment taxSize 22 KB Download You have a neat and professional independent contractor agreement here that talks about what services the contractor has agreed to perform, the payment, expenses, vehicles and equipment, status of the independent contractor etc

50 Free Independent Contractor Agreement Forms Templates

Do You Need An Independent Contractor Agreement Includes Free Sample Template Womply

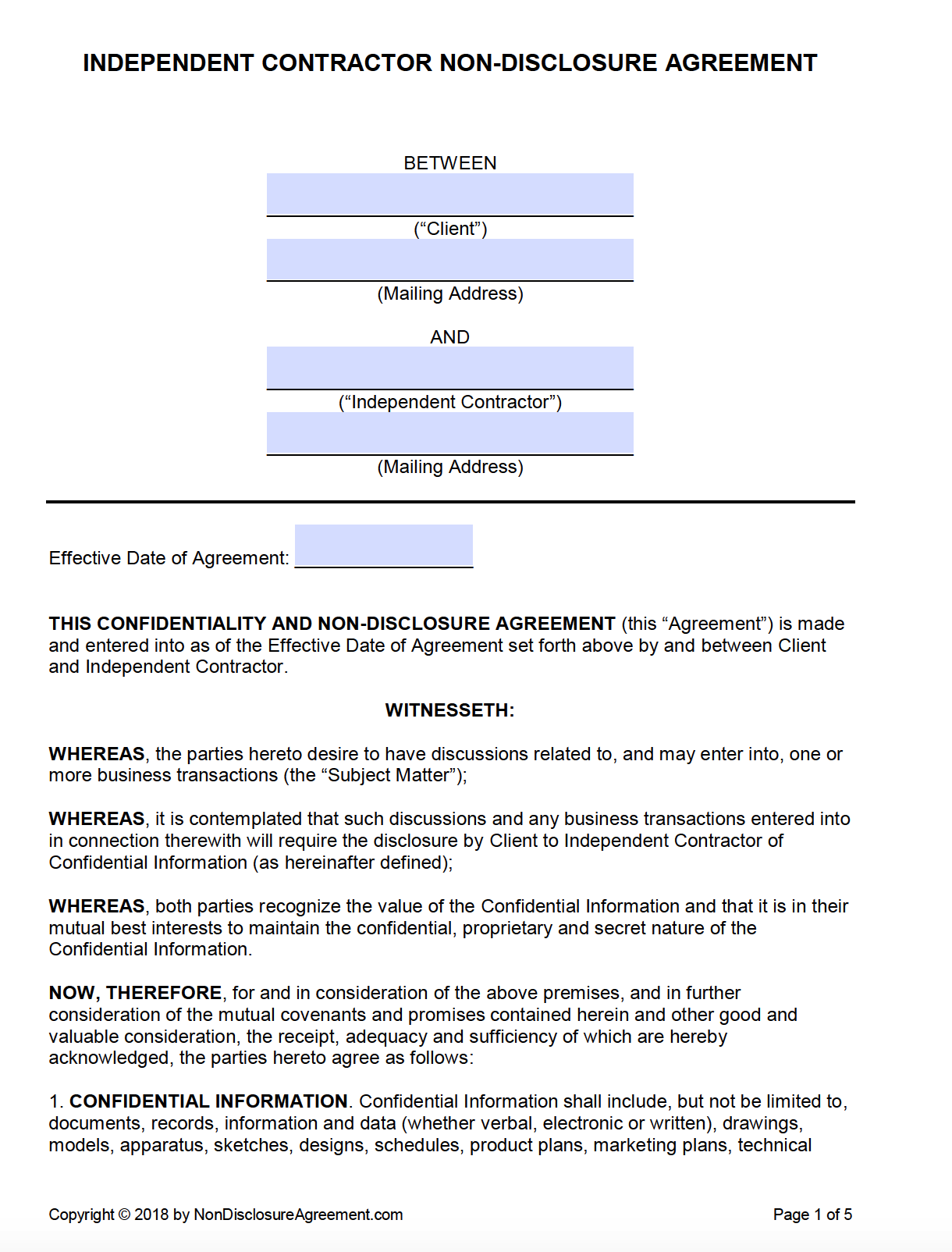

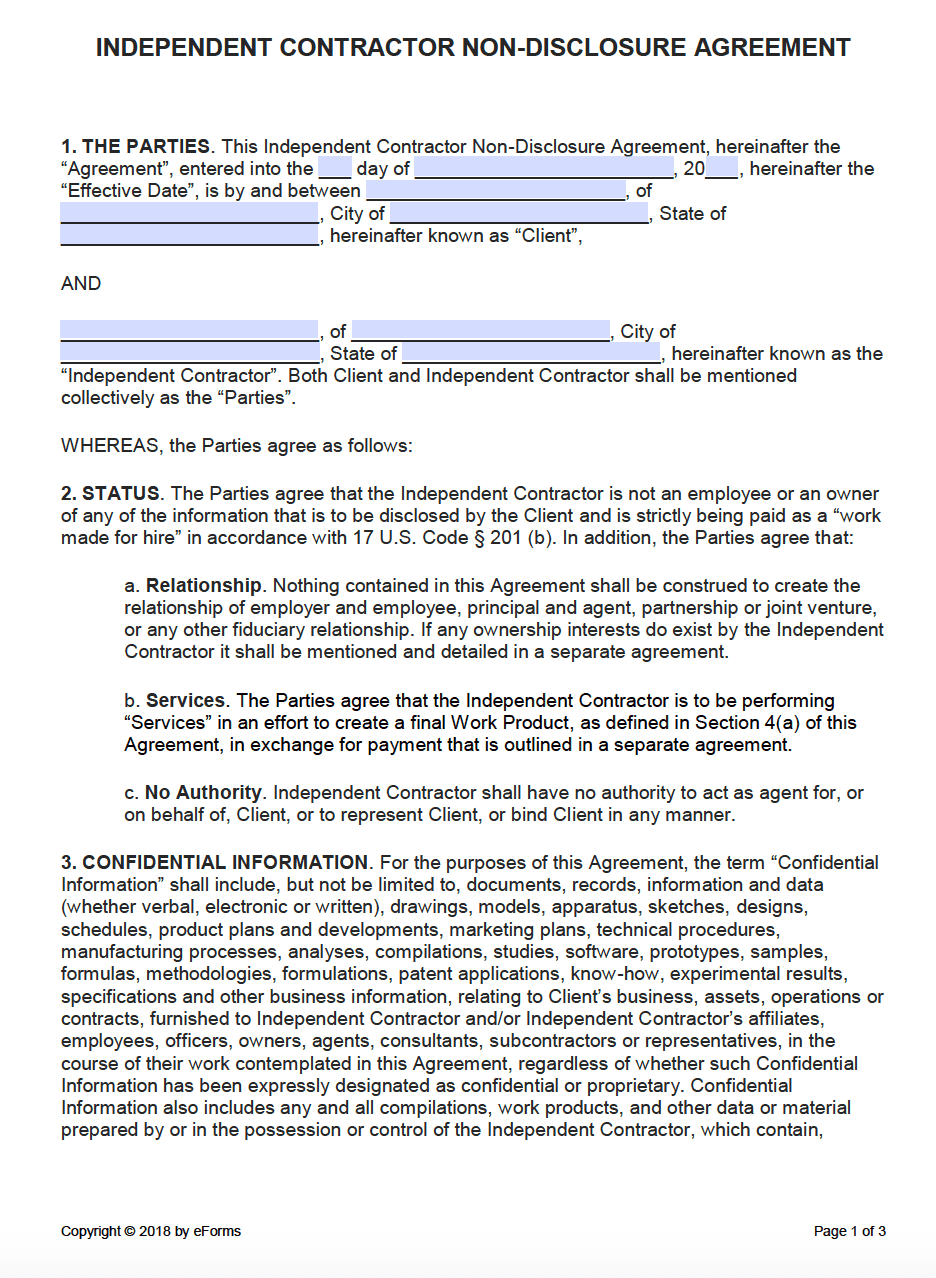

The independent contractor nondisclosure agreementis intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state lawsIt may be terminated by the Corporation with cause – defined as (1) the failure of the Contractor to act in furtherance of the interests of the Corporation and its clients, (2) a material violation by the Contractor of any provision of this Agreement, (3) the conviction of the Contractor of a crime, or (4) an act or omission which in the sole opinion of the Corporation evidences moral turpitudeThis letter of agreement includes our entire agreement with respect to your status as an independent contractor and supersedes all oral discussions, which we may have had This agreement may be amended or assigned by you and the Practice at any time only by an instrument in writing signed by both parties

Everything You Need To Know About Paying Contractors Wave Blog

Instant Form 1099 Generator Create 1099 Easily Form Pros

That in performing under the Agreement;As well as your own health benefits, medical expenses, life insurance, and retirement fundAnd (c) the Services and any work product thereof are the

Free Subcontractor Agreement Free To Print Save Download

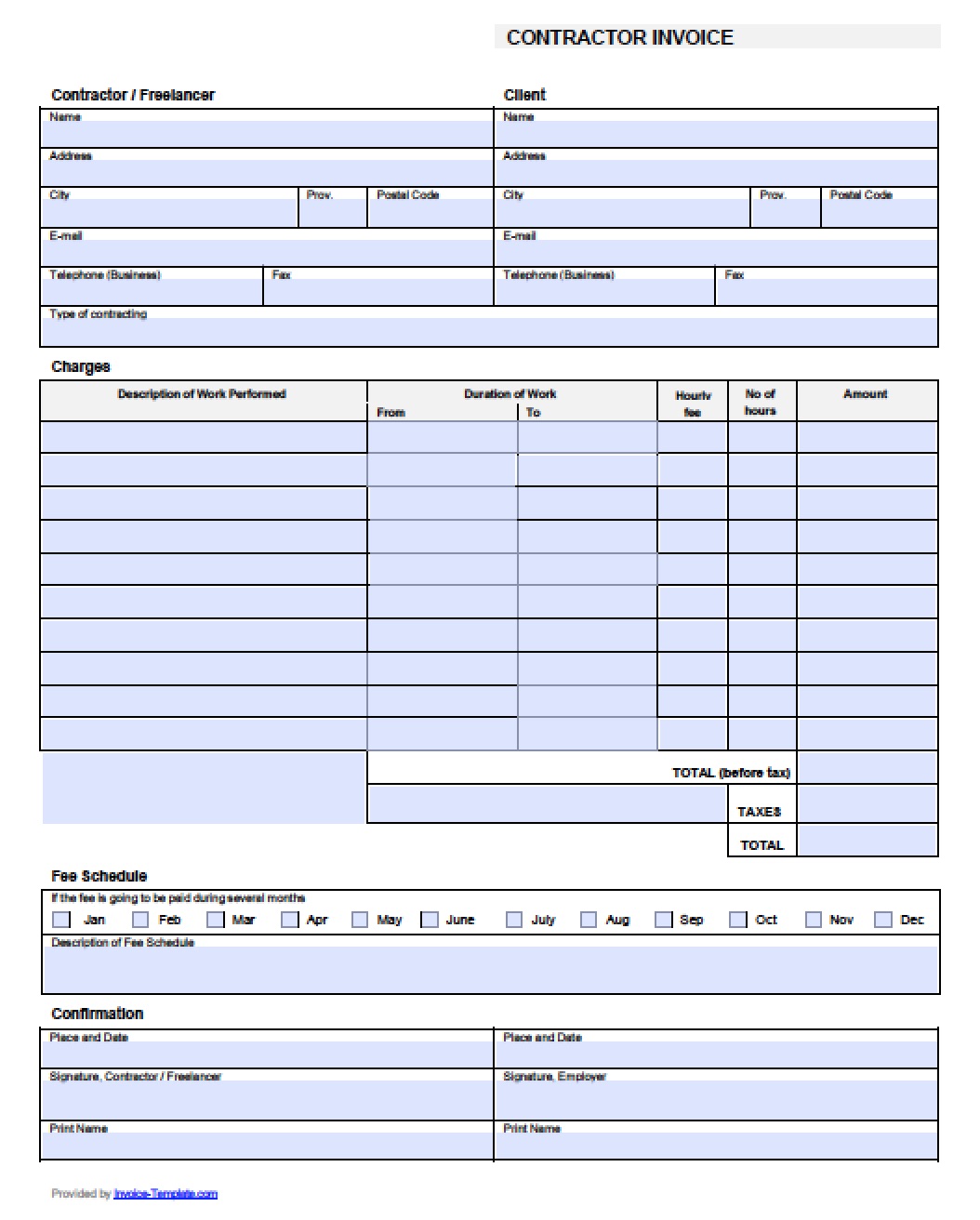

Independent Contractor Invoice Template Excel Lovely Independent Contractor Invoice Template Invoice Template Word Invoice Template Template Design

Independent Contractor Services Agreement download now;The Independent Contractor that Contractor considers materially harmful to the Practice No notice is required if this agreement is terminated for cause Independent Contractor agrees to immediately notify Contractor in the event Independent Contractor's license to practice psychology, therapy, orConstruction Independent Contractor Agreement download now;

All You Need To Know When Hiring Foreign Independent Contractors

Newportbeachca Gov Home Showdocument Id

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesSimple Independent Contractor Agreement download now;Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itself It is a clearcut explanation of the expected workflow, how communication will be handled, and how the relationship will work

Independent Contractor Agreement Form California New Independent Contractor Agreement Template 50 New Independent Models Form Ideas

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Services Agreement Invitrogen Corp and Lyle C Turner () Independent Contractor Agreement for Services Macromedia Inc and Al Ramadan () Independent Contractor Agreement Diversified Opportunities Group LtdContractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;And withholdings, and Company shall file an IRS Form 1099 reflecting all contractual payments paid by Company to Contractor under this Agreement Contractor and Company further agree that 1 Contractor has the right to perform services for others during the term of this Agreement

Independent Contractor Agreement For Programming Services Template By Business In A Box

Free Independent Contractor Agreement Templates Word Pdf

Basic Independent Contractor Agreement download now;Sample 2 Independent Contractor Indemnification The parties understand and agree that this Agreement is not a contract of employment in the sense that the relation of master and servant exists between District and Republic or between District and any employee of Republic Republic shall, at all times, be deemed to be an independent contractor Let's have an insight of 25 1099 deductions for independent contractors which you may not aware of Now identify and track qualified business expenses and

Free Digital Marketing Contract For 21 Pdf Template Bonsai

Sample Independent Contractor Non Compete Agreement Word Pdf

Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply) Form Independent Contractor Agreement – Telemarketer Description This is a sample form of Independent Contractor Agreement between a company and an independent telemarketer The work responsibilities are set forth in Exhibit A The form is procompany orientedSample independent contractor agreements are available online If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in

Employee Versus Independent Contractor The Cpa Journal

Free Trucking Contract Free To Print Save Download

Because Consultant is not an employee of the Company, but rather an independent contractor, the Company shall issue an IRS Form 1099 Consultant agrees to report all compensation received under this Agreement to the appropriate federal, state or local taxing authorities 30 Simple Independent Contractor Agreements (100% Free) 6 Mins Read You can simplify your hiring process of an independent contractor with the use of a standardized contractor agreement Before seeking service of an individual or an agency, it is important to clearly define the scope of work and put down all the relevant terms andContractor acknowledges that it will be necessary for Client to disclose certain confidential and proprietary information to Contractor in order for Contractor to perform duties under this Agreement Contractor acknowledges that disclosure to a third party or misuse of this proprietary or confidential information would irreparably harm Client

50 Free Independent Contractor Agreement Forms Templates

Nurse Practitioner Employment Contract Template For Primary Care Setting Pdf Free Download

Provided however, the Services must be provided at the1099 Independent contractor / Food Broker / Business Developement Aug 14 - Feb 15 Sabin Meyer Corp - Eastchester, NY Serviced the largest foodservice and retail distributors in the NY Metro market;An independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative names

Video 4 14 Independent Contractor Agreement Youtube

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

INDEPENDENT CONTRACTOR AGREEMENT This Independent Contractor Agreement ("Agreement") made _____, ____ by and between _____ ("Employer") and _____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilitiesExhibit 1011 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor")Each of ViSalus and Contractor are sometimes referred to individually This form is not filed with the IRS but is required to be held by the payer of services for at least four (4) years IRS Form 1099 – To be filed with the IRS at the end of the year if the payer paid an independent contractor $600 or more Must be

/GettyImages-481518099-5c5c983fc9e77c00010a47cc.jpg)

What Is An Independent Contractor

50 Free Independent Contractor Agreement Forms Templates

The contract signed between a contractor and their client is known as an Independent Contractor Agreement This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor An Independent Contractor Agreement can also be known as a Freelance Contract Consulting Agreement The agreement needs to be structured in a way that protects the independent contractor from having to perform work they don't want to do or that would present financial difficulty For example, a graphic designer will want to set terms in regards to design revisions to set client expectations and time constraintsINDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT is between Family Counselling and Support Services for Guelph Wellington (the "Company") and XXXX (the "Contractor") (collectively referred to as the "Parties") This contact will be in effect from – 1x to 1x In consideration of their mutual promises, the Parties agree as follows

Newportbeachca Gov Home Showdocument Id

Nurse Practitioner Employment Contract Template For Primary Care Setting Pdf Free Download

This is an Independent Contractor Agreement ("Agreement") dated as of _____, ___ between _____, a California nonprofit corporation ("Client"), and _____, a _____ ("Contractor") Background Client is a nonprofit organization whose mission is insert mission Contractor is anE Sample Independent Contractor Agreement This sample agreement should be reviewed and approved by your attorney prior to use This Independent Contractor Agreement ("Agreement") is entered into effective _____Order and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance

Free General Contractor Invoice Template Pdf Word Excel

10 Must Haves In An Independent Contractor Agreement

Sysco Metro NY, Sysco Long Island, US Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them Difference Between Subcontractor and Independent Contractor Independent contractors labor for themselves, but are employed by an employer to do a project or for a specific period of timeIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agrees

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Free Independent Contractor Agreement Template Download Wise

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and _____("Contractor"), Federal Identification (or Social Security) _____An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSAgreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services;

50 Free Independent Contractor Agreement Forms Templates

My Exostar Com Download Attachments 3236 Sample employement letter Pdf Version 2 Modificationdate Api V2

CONTRACTOR will never solicit (while this Independent Contractor Agreement is and accounts receivable, and provide CONTRACTOR with 1099 tax forms c) Dispatching The COMPANY will maintain a telephone answering and appointment setting service for the INDEPENDENT CONTRACTORSample Independent Contractor Agreement lawberkeleyedu Details File Format Doc; An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreements

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Letter Sample Contract

Tattoo Shop Artist Agreement Fill Online Printable Fillable Blank Pdffiller

Independent contractor The Company will not be responsible for filing or paying any local, federal or state taxes Furthermore, the Company will not provide retirement or any other benefits Agreement, disclose any such information or any part thereof to any person, firm, corporation,

Free California Independent Contractor Agreement Word Pdf Eforms

F R E E C O N T R A C T O R F O R M S T O P R I N T Zonealarm Results

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Free Employment Contract Agreement Pdf Word Eforms Free Fillable Forms Contract Agreement Contract Template Separation Agreement

Subcontractor Agreement Construction Fill Online Printable Fillable Blank Pdffiller

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Independent Contractor Agreement Example

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Contractor Invoice Templates Free Download Invoice Simple

Self Contract Template Fill Online Printable Fillable Blank Pdffiller

55 Small Business Ideas Business Proposal Template Business Proposal Sample Free Proposal Template

New Truck Driver Independent Contractor Agreement Models Form Ideas

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

50 Editable Contract Termination Letters Free Templatearchive

New Truck Driver Independent Contractor Agreement Models Form Ideas

Independent Contractor Taxes Guide 21

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Http Manoa Hawaii Edu Careercenter Files Independent Contractors Pdf

Free Non Compete Agreement Templates Employee Contractor

3

Independent Contractor Contract Template The Contract Shop

Nurse Practitioner Employment Contract Template For Primary Care Setting Pdf Free Download

Free Florida Independent Contractor Agreement Pdf Word

Newportbeachca Gov Home Showdocument Id

Employee Or Independent Contractor Which One Is Best For My Business The Association Of Fitness Studios

50 Free Independent Contractor Agreement Forms Templates

How To Legally Hire Independent Contractors Updated In 18

Free Employment Agreements Contracts Pdf Word

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Sample Real Estate Independent Contractor Agreement Brilliant 1099 Contractor Agreement Form Models Form Ideas

Consulting Agreement Template Fill Online Printable Fillable Blank Pdffiller

Acknowledgment Of Independent Contractor Template By Business In A Box

Free Notice Of Contract Termination Free To Print Save Download

Free Sales Representative Contract Free To Print Save Download

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Free Subcontractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

50 Editable Contract Termination Letters Free Templatearchive

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Truck Driver Independent Contractor

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Pdf Word

Lsoa School 1099 Agreement

3

How To Write An Independent Contractor Agreement Mbo Partners

Free Subcontractor Agreement Template Pdf Word

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

Free Professional Marketing Agreement Template For Download

Independent Contractor 1099 Invoice Templates Pdf Word Excel

7 Independent Contractor Invoice Templates Pdf Word Free Premium Templates

1

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Exh10 1 Htm

Freelance Contract Template Free Download Wise

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Agreement Template Contract The Legal Paige

3

Http Www Mach4marketing Com Downloads Sales rep 1099 agreement Pdf

Employee Vs Independent Contractor Checklist To Do List Organizer Checklist Pim Time And Task Management Software For Better Personal And Business Productivity

Independent Contractor Agreement Business Taxuni

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

F R E E C O N T R A C T O R F O R M S T O P R I N T Zonealarm Results

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Self Employment Contract Sample Employment Ihtf

Free Professional Marketing Agreement Template For Download

Www Nelp Org Wp Content Uploads Home Care Misclassification Fact Sheet Pdf

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

Independent Contractor 1099 Invoice Templates Pdf Word Excel

0 件のコメント:

コメントを投稿